Nonprofit Payroll

Spend more time on your nonprofit mission and less time on payroll and taxes.

All Fields Required

Understanding nonprofit payroll

When it comes to running a business, a nonprofit has some rules and regulations that are different than for-profit companies. Some of these differences will affect how you operate payroll, so it’s important that you are choosing a payroll service that can accommodate nonprofit payoll.

Nonprofit Tax Exemptions

Due to the nature of nonprofits, there are different tax exemptions to be aware of. However, not all nonprofits have the same tax exemptions. A fully exempt nonprofit may be exempt from most federal income taxes and some state taxes. Not all nonprofits will be eligible for both of these exemptions. The most common tax organization for charitable nonprofits is 501(c)(3).

According to the IRS website, “to be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.” If your nonprofit follows this tax organization, the organization will receive an income tax exemption, and donors may take a tax deduction for their donations.

Additionally, besides being away of section 501(c)(3), there are a variety of other forms your nonprofit may be responsible for filing for exemptions. The IRS provides a full list of forms and instructions for exempt organizations.

Employee Classification

Do you fully understand who your employees are? What we mean by this is, are you sure you’re classifying your employees correctly?

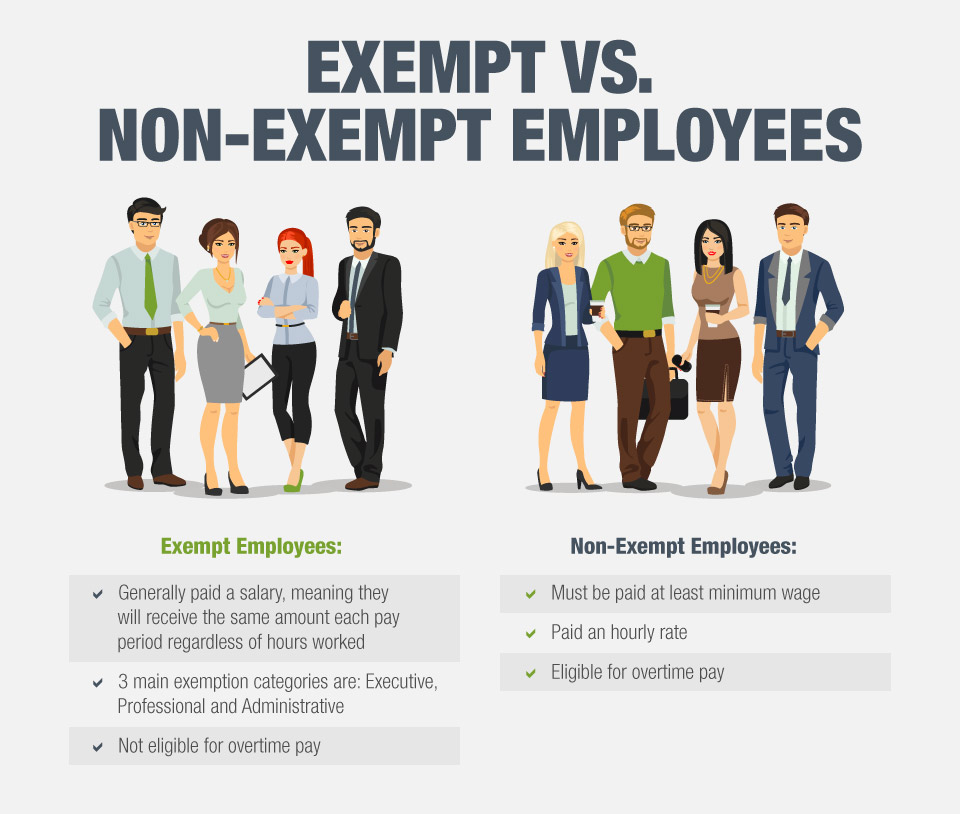

While you may have a mix of full-time, part-time and hourly employees working at your nonprofit, there are special ways besides those categories that you need to classify your employees, specifically exempt vs. non-exempt. Misclassifying your employees can lead to larger payroll headaches.

Bonuses and Commissions

One way that nonprofit payroll differs from for-profit businesses is in the form of bonuses and commissions. In a for-profit setting, it’s common for employees to receive quarterly and year-end bonuses. Additionally, in a sales setting, many employees get paid a commission. In the nonprofit sector, funds are collected for a specific cause. Therefore individuals internal to the organization are unable to benefit from the money it raises and won’t receive a bonus or commission.

How SurePayroll Can Help Your Nonprofit

We are willing to bet that the reason you work for a nonprofit is because of the cause it supports and you love the work that you do. We are also willing to be that handling nonprofit payroll and tax issues aren’t something that sparks joy on your philanthropic journey. Not all online payroll providers are created equal, so it’s important to choose wisely when it comes to payroll software for nonprofit organizations. When choosing SurePayroll, you get:

- The peace of mind that any taxes will be paid and filed on time – we guarantee it.*

- Access to our free payroll app so you can process payroll on the go, whether you are hosting an event for your nonprofit or out focusing on other needs for your business.

- Direct deposit or print checks yourself

- Access to U.S.-based customer service including evening and weekend hours

*If you receive a notice from the IRS, or any other tax agency, based on a filing that SurePayroll made for your organization, we’ll work with the agency to help resolve the issue on your behalf. And, if we’re at fault, we’ll pay all the associated penalties and fines.